CBAM: What Businesses Need to Know About the EU’s Carbon Border Adjustment Mechanism

Why CBAM Matters

At its core, CBAM is a climate policy tool designed to prevent “carbon leakage” — the scenario where companies shift production to countries with less stringent environmental regulations. By pricing carbon at the EU border, the mechanism levels the playing field for European producers while encouraging global partners to decarbonize their value chains.

The initial sectors under CBAM include:

Cement

Iron and steel

Aluminium

Fertilizers

Hydrogen

Electricity

These industries were selected based on their high carbon intensity and risk of carbon leakage.

The Current Landscape: Transition Phase

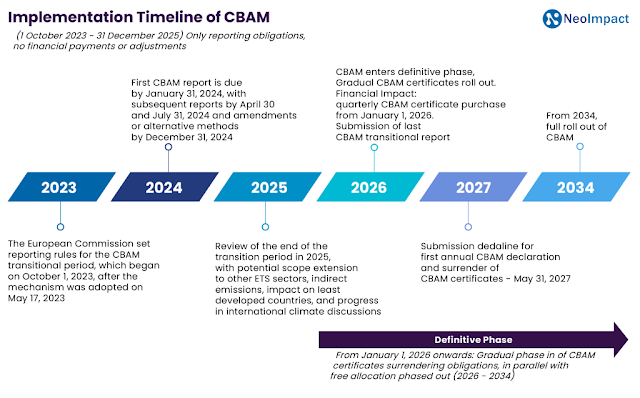

Since October 2023, companies have been required to report embedded emissions in their exports to the EU — even though financial penalties or levies are not yet in place. This transition phase runs until the end of 2025 and is aimed at helping businesses build capacity for full compliance.

Under this reporting obligation:

Quarterly CBAM reports must be submitted

Accurate emissions data must be collected and verified

Reporting gaps or errors could lead to scrutiny or future non-compliance risks

Full Implementation Ahead

From January 1, 2026, EU importers will be required to purchase CBAM certificates to cover the embedded emissions in imported goods. This marks a significant shift, as it assigns a financial cost to carbon at the point of entry — based on the weekly average of the EU Emissions Trading System (ETS) carbon price.

For exporters and manufacturers, this translates to:

Increased demand for transparent supply chain emissions data

Competitive pressure to adopt cleaner production methods

Strategic need to reassess carbon pricing exposure

Global Implications Beyond the EU

CBAM may be an EU-led policy, but its ripple effects are global. Countries that rely on carbon-intensive exports to the EU — including India, China, Turkey, and parts of Southeast Asia — are already exploring domestic carbon pricing frameworks and clean technology incentives to remain competitive.

This also creates a new dimension to trade strategy, where ESG metrics and low-carbon manufacturing are no longer optional but essential.

Key Actions for Businesses

Map and measure embedded emissions in products covered under CBAM.

Improve data quality across suppliers and production facilities.

Prepare for third-party verification of emission reports.

Engage cross-functional teams — from compliance to operations — to align on reporting strategies.

Monitor regulatory updates, as the EU may expand CBAM to additional sectors over time.

Final Thought

CBAM is a landmark shift in how environmental impact is integrated into international trade. As climate accountability gains momentum, businesses that invest early in emissions transparency and reporting systems are more likely to remain competitive — and credible — in the evolving global market.

Comments

Post a Comment